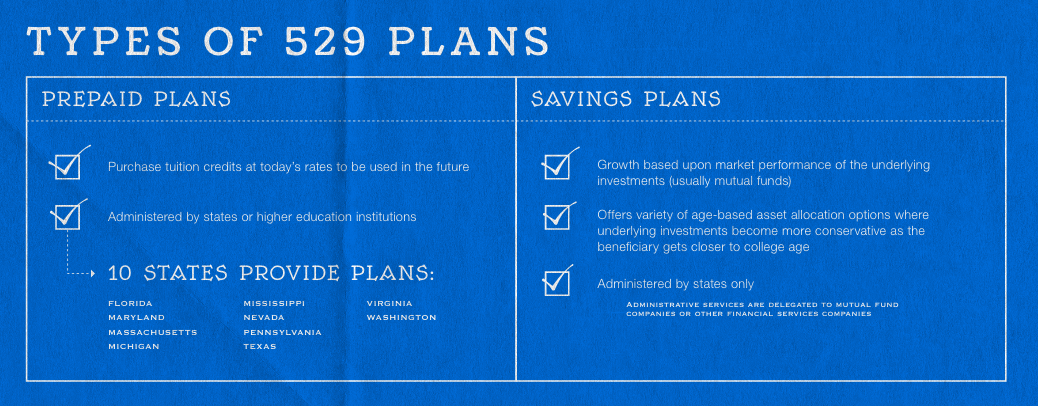

Named after Section 529 of the Internal Revenue Code, 529 plans are investment accounts used to pay for a beneficiary’s college expenses and are usually opened many years before the beneficiary reaches college age. Check out this infographic for some interesting statistics about 529 Plans.

Get in Touch

In just minutes we can get to know your situation, then connect you with an advisor committed to helping you pursue true wealth.

Contact UsLatest Posts

401(k) Calculator

Determine how your retirement account compares to what you may need in retirement.

Get StartedRelated Content

Small Business Owners

199A Deduction – Big Change for Small Business Owners Two-hundred-forty-seven pages later, we have one large IRS document and a whole lot of questions. For small business owners, 199A deductions are complex. Do you fall into the 95 percent of small business owners covered? When do 199A dedu …

Divorce Planning

Divorce can be emotionally and financially stressful but with the proper planning, you can get through it with your finances and future intact. Here are some stats to consider when it comes to the financial impact of divorce. Click here to open fullscreen

Long-Term Care

Do you know someone who has recently been diagnosed with dementia or is currently living with this disease? Watching a loved one lose their independence, memories and financial well-being is very difficult. It’s important to know there are many resources and tools available to you. This inf …

Long-Term Care

Do you know someone who has recently been diagnosed with dementia or is currently living with this disease? Watching a loved one lose their independence, memories and financial well-being is very difficult. It’s important to know there are many resources and tools available to you. This inf …

Long-Term Care

Our goal is to make your life easier. Caring for a loved one with Alzheimer’s or dementia can be highly stressful for caregivers and family members. Providing answers on how to financially prepare for these conditions is one way we can help. Read this guide for tips on how to prepare for th …

Millennials

Is a million dollars enough to last a lifetime? Many often think they have enough to live on until they plan to retire; however, they don’t consider the lifestyle they want to live post-retirement. View our infographic here to quantify a million. Click here to open fullscreen

Estate Planning

Many often think estate planning only benefits the wealthy, but this is a common misconception. View our infographic here to see what you need to engage in! Click here to open fullscreen

Back 2 Basics

Check out this infographic for 12 Simple Financial Tips that are important to remember but easy to forget! Click here to open fullscreen

Disciplined Investment Process

As an investor are you following a disciplined investment process or are you lacking a measurable strategy in your investment decisions? Consider your long-term investment objectives. As the markets go up and down, it can be challenging to keep your emotions in check if you are not followin …

4 Challenges During Retirement

No matter how well-prepared you may feel for life in retirement, none of us is immune to the challenges presented by market volatility, rising taxes and inflation and longevity. Fluctuations in the financial markets, interest rates and the value of the dollar affect the price of the goods a …